SEC Adopts New Private Fund Adviser Rules

A divided SEC adopted numerous reforms for private fund managers on August 23, 2023. These reforms represent the largest regulatory change for private fund managers since Dodd-Frank. The SEC’s stated purpose is to bring “transparency” to the operation of private funds by, among other things, restricting or requiring disclosure of preferential terms such as those granted in side letters as well as requiring advisers to address conflicts of interest.

We expect that each private fund adviser will be significantly impacted by the new regulations. In comparison to the proposed rule, the final rule represents an improvement for advisers as a number of restrictions are now permissible with disclosure and/or investor consent. In addition, a legacy product exemption (i.e., grandfathering), which was absent from the proposed rule, was added to a number of the provisions.

The new rule generally applies to managers of private funds but includes various nuances for SEC registered, exempt-reporting advisers (ERAs), state advisers and unregistered sponsors. The rule is also primarily limited to those advisers that manage “private funds.” Private funds mean those relying on either Section 3(c)(1) or 3(c)(7) of the Investment Company Act of 1940. Notably, this does not include funds relying on other exemptions such as is common for real estate or real assets funds. The SEC also excluded securitized asset products such as CLOs from the new rule.

Compliance dates for the new rule are generally split between large private fund advisers with $1.5 billion or more in private funds assets under management and smaller advisers with under $1.5 billion in private funds assets. Compliance dates are generally either 12 months from publication in the Federal Register (September 14, 2024) for large advisers or 18 months (March 14, 2025) for smaller advisers. However, the new written report requirement for annual compliance reviews will take effect 60 days after publication (November 13, 2023).

The changes include new robust quarterly reporting requirements with respect to fees and expenses as well as performance disclosures. As a result, advisers will need to review existing reporting and update for compliance with the rule. The new rule also includes prohibitions and disclosure requirements on preferential liquidity and information rights. Side letters remain a clear target of the SEC in the final rule, and careful attention will need to be paid to satisfy the new requirements. The rule also restricts advisers from seeking reimbursement for the cost of adviser compliance, regulatory and government investigations without disclosure and, in case of investigations, without investor consent; provided the adviser is not found liable for violations of the Advisers Act, in which case, reimbursement is not permitted.

Side Letters and MFNs

One result of the new rule will be a significant change to closing, side letter and MFN-election processes. Disclosure will now be required for all material economic terms granted to the other investors prior to admitting each new investor. The mechanics surrounding this requirement are not clear. Advisers may face challenges in handling multiple investors closing on the same date with various preferential terms.

In addition, all preferential treatment terms regardless of materiality must ultimately be disclosed. For closed-end funds such as private equity or venture capital, the SEC indicated that all preferential treatment disclosures must be made as soon as reasonably practicable after the final closing. For open-end funds such as hedge funds, disclosure will be required as soon as reasonably practicable following the investors investment. Excuse rights were identified by the SEC as a post final closing (i.e., non-material) term. An adviser can provide a summary of the preferential terms or include the actual provisions in the disclosures. There are no grandfathering provisions for this new requirement.

Given the above changes, the MFN process for closed-end fund advisers will become bifurcated. Certain side letter terms will require disclosure prior to the final closing, while others will only be disclosed after the final closing. The practice of showing investors only certain provisions to which they are eligible to elect will likely cease since the adviser will be required to disclose all preferential terms regardless of the investor’s size. That being said, advisers are not required to offer such terms to every investor.

Delivery of the new disclosure will also require advisers to reevaluate their existing investor communication options. We believe that supplements to private placement memorandums will be the preferred notice method combined with cloud-based investor data rooms.

Quarterly and Annual Statements

The new rule includes very prescriptive disclosure requirements as detailed below. The SEC also wants much of the information set forth separately and not aggregated. The rule also requires “clear and prominent disclosure” of the methodologies and assumptions made in calculating fund performance and requires clear, concise, plain English presentations that will facilitate review from one quarterly statement to the next. These new provisions will require significant efforts by advisers to ensure proper compliance with these very technical requirements.

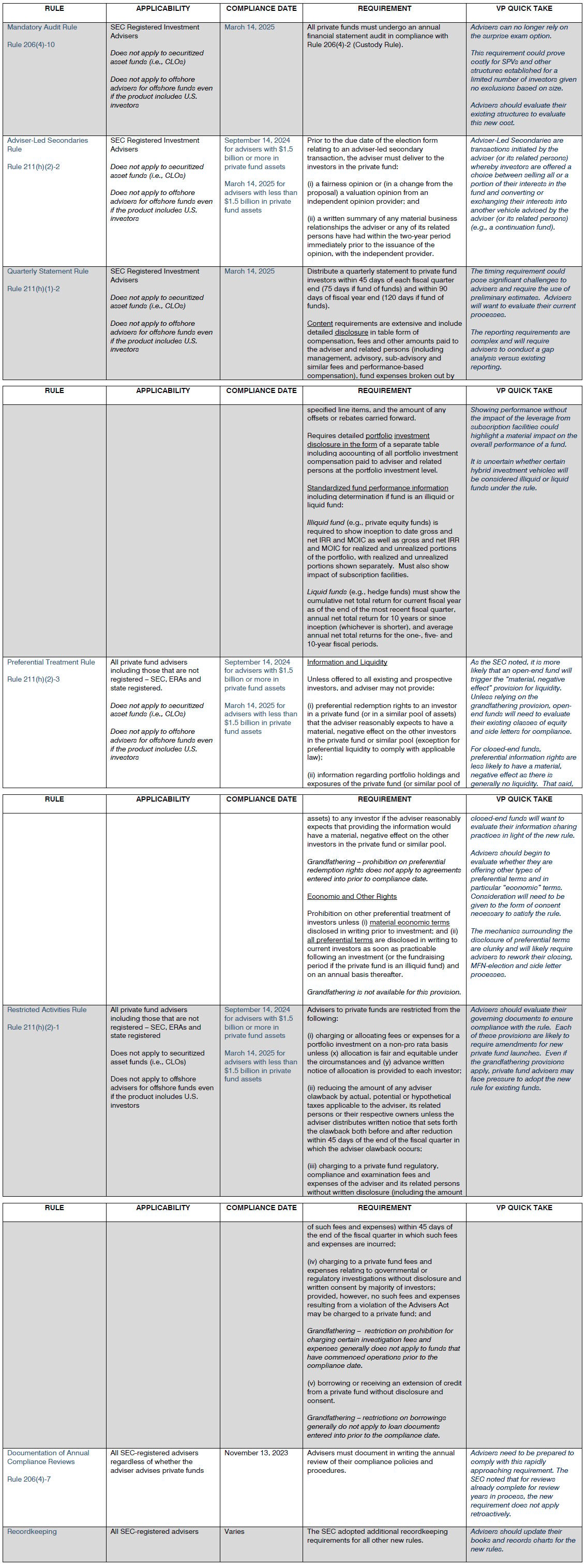

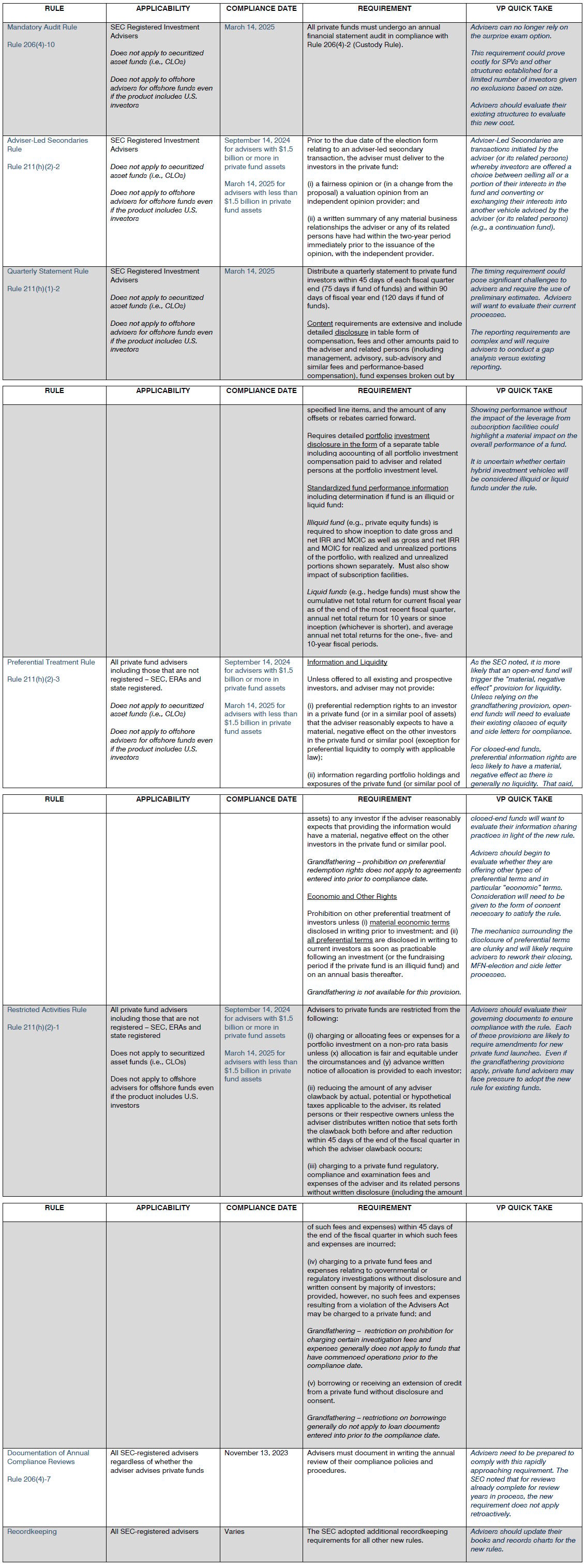

The summary below is an overview of the requirements and restrictions detailed in the rule. The summary should be considered a general summary.

Note that earlier this month several private fund trade groups sued the SEC arguing the agency overstepped its statutory authority when adopting the new rule. While the outcome of this lawsuit is unknown, it is possible that the new rule will not become effective on the compliance dates noted below. Accordingly, advisers will want to pay close attention to this litigation.

Final Private Funds Rule – Summary Guide

If you have any questions, please contact Joseph M. Mannon at jmannon@vedderprice.com, Cody J. Vitello at cvitello@vedderprice.com, Jeff VonDruska at jvondruska@vedderprice.com or any other Vedder Price attorney with whom you have worked.

Vedder Thinking | Articles SEC Adopts New Private Fund Adviser Rules

Article

September 21, 2023

A divided SEC adopted numerous reforms for private fund managers on August 23, 2023. These reforms represent the largest regulatory change for private fund managers since Dodd-Frank. The SEC’s stated purpose is to bring “transparency” to the operation of private funds by, among other things, restricting or requiring disclosure of preferential terms such as those granted in side letters as well as requiring advisers to address conflicts of interest.

We expect that each private fund adviser will be significantly impacted by the new regulations. In comparison to the proposed rule, the final rule represents an improvement for advisers as a number of restrictions are now permissible with disclosure and/or investor consent. In addition, a legacy product exemption (i.e., grandfathering), which was absent from the proposed rule, was added to a number of the provisions.

The new rule generally applies to managers of private funds but includes various nuances for SEC registered, exempt-reporting advisers (ERAs), state advisers and unregistered sponsors. The rule is also primarily limited to those advisers that manage “private funds.” Private funds mean those relying on either Section 3(c)(1) or 3(c)(7) of the Investment Company Act of 1940. Notably, this does not include funds relying on other exemptions such as is common for real estate or real assets funds. The SEC also excluded securitized asset products such as CLOs from the new rule.

Compliance dates for the new rule are generally split between large private fund advisers with $1.5 billion or more in private funds assets under management and smaller advisers with under $1.5 billion in private funds assets. Compliance dates are generally either 12 months from publication in the Federal Register (September 14, 2024) for large advisers or 18 months (March 14, 2025) for smaller advisers. However, the new written report requirement for annual compliance reviews will take effect 60 days after publication (November 13, 2023).

The changes include new robust quarterly reporting requirements with respect to fees and expenses as well as performance disclosures. As a result, advisers will need to review existing reporting and update for compliance with the rule. The new rule also includes prohibitions and disclosure requirements on preferential liquidity and information rights. Side letters remain a clear target of the SEC in the final rule, and careful attention will need to be paid to satisfy the new requirements. The rule also restricts advisers from seeking reimbursement for the cost of adviser compliance, regulatory and government investigations without disclosure and, in case of investigations, without investor consent; provided the adviser is not found liable for violations of the Advisers Act, in which case, reimbursement is not permitted.

Side Letters and MFNs

One result of the new rule will be a significant change to closing, side letter and MFN-election processes. Disclosure will now be required for all material economic terms granted to the other investors prior to admitting each new investor. The mechanics surrounding this requirement are not clear. Advisers may face challenges in handling multiple investors closing on the same date with various preferential terms.

In addition, all preferential treatment terms regardless of materiality must ultimately be disclosed. For closed-end funds such as private equity or venture capital, the SEC indicated that all preferential treatment disclosures must be made as soon as reasonably practicable after the final closing. For open-end funds such as hedge funds, disclosure will be required as soon as reasonably practicable following the investors investment. Excuse rights were identified by the SEC as a post final closing (i.e., non-material) term. An adviser can provide a summary of the preferential terms or include the actual provisions in the disclosures. There are no grandfathering provisions for this new requirement.

Given the above changes, the MFN process for closed-end fund advisers will become bifurcated. Certain side letter terms will require disclosure prior to the final closing, while others will only be disclosed after the final closing. The practice of showing investors only certain provisions to which they are eligible to elect will likely cease since the adviser will be required to disclose all preferential terms regardless of the investor’s size. That being said, advisers are not required to offer such terms to every investor.

Delivery of the new disclosure will also require advisers to reevaluate their existing investor communication options. We believe that supplements to private placement memorandums will be the preferred notice method combined with cloud-based investor data rooms.

Quarterly and Annual Statements

The new rule includes very prescriptive disclosure requirements as detailed below. The SEC also wants much of the information set forth separately and not aggregated. The rule also requires “clear and prominent disclosure” of the methodologies and assumptions made in calculating fund performance and requires clear, concise, plain English presentations that will facilitate review from one quarterly statement to the next. These new provisions will require significant efforts by advisers to ensure proper compliance with these very technical requirements.

The summary below is an overview of the requirements and restrictions detailed in the rule. The summary should be considered a general summary.

Note that earlier this month several private fund trade groups sued the SEC arguing the agency overstepped its statutory authority when adopting the new rule. While the outcome of this lawsuit is unknown, it is possible that the new rule will not become effective on the compliance dates noted below. Accordingly, advisers will want to pay close attention to this litigation.

Final Private Funds Rule – Summary Guide

If you have any questions, please contact Joseph M. Mannon at jmannon@vedderprice.com, Cody J. Vitello at cvitello@vedderprice.com, Jeff VonDruska at jvondruska@vedderprice.com or any other Vedder Price attorney with whom you have worked.